Things about Hard Money Georgia

Wiki Article

Getting The Hard Money Georgia To Work

Table of ContentsHard Money Georgia Fundamentals ExplainedHow Hard Money Georgia can Save You Time, Stress, and Money.Hard Money Georgia for DummiesThe Only Guide to Hard Money GeorgiaThe Facts About Hard Money Georgia Uncovered

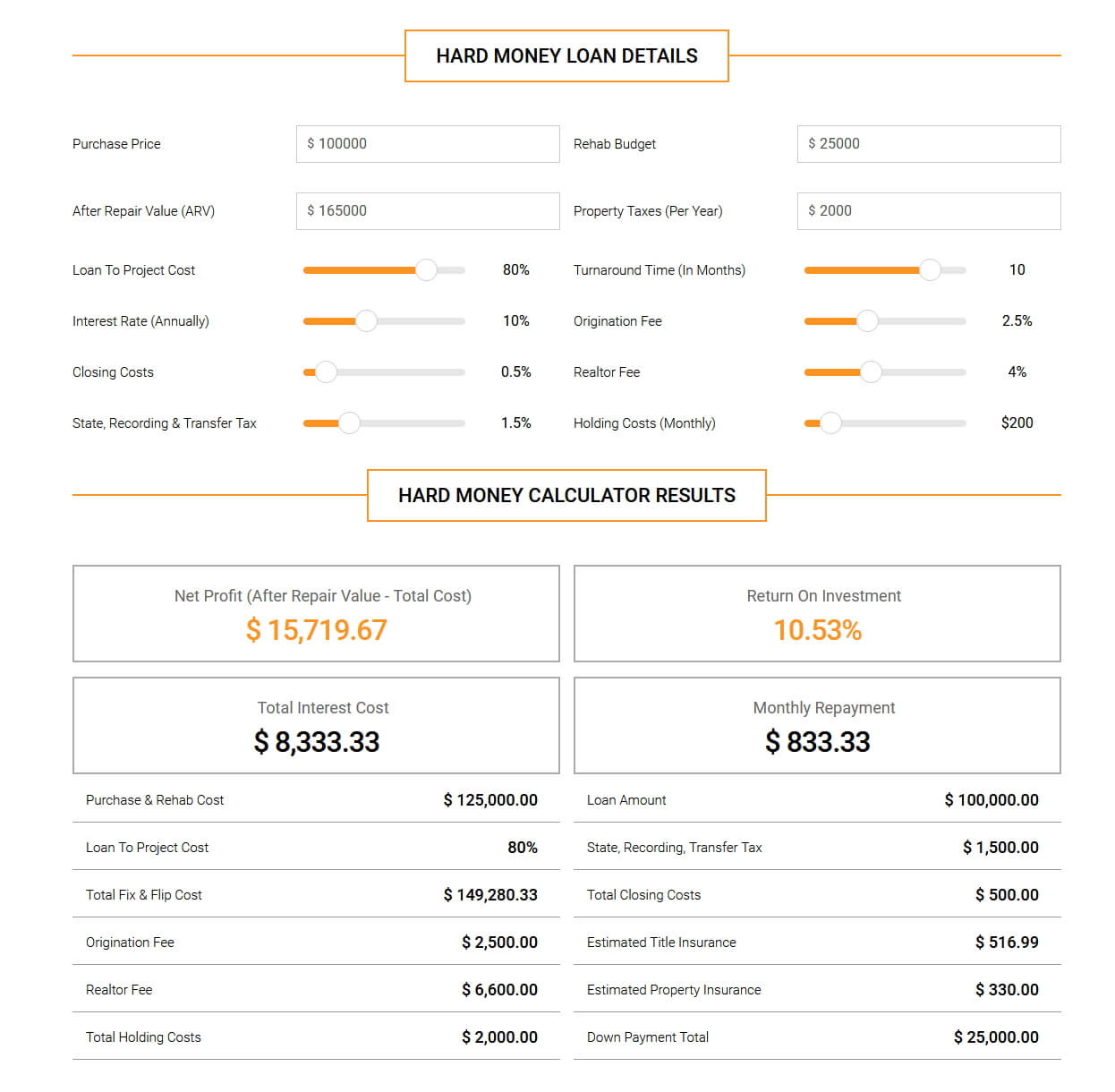

A particular capital buffer is still required. Hard money lendings, sometimes referred to as swing loan, are short-term borrowing tools that investor can make use of to fund an investment project. This kind of finance is frequently a device for residence fins or realty programmers whose goal is to renovate or develop a building, after that offer it for a profit. There are two key downsides to consider: Difficult cash financings are hassle-free, yet investors pay a price for borrowing by doing this. The price can be approximately 10 percent points greater than for a conventional finance. Source costs, loan-servicing costs, and shutting prices are also likely to cost investors more (hard money georgia).

As a result, these lendings include much shorter payment terms than traditional home mortgage fundings. When choosing a tough money lending institution, it's crucial to have a clear idea of exactly how soon the property will come to be lucrative to ensure that you'll be able to pay off the car loan in a prompt way.

Some Ideas on Hard Money Georgia You Need To Know

Once more, lending institutions might enable financiers a bit of freedom right here.Difficult money fundings are a great suitable for well-off financiers who need to obtain financing for a financial investment property promptly, with no of the red tape that goes along with bank funding. When examining difficult money lenders, pay attention to the costs, rates of interest, and lending terms. If you wind up paying way too much for a hard cash finance or cut the repayment duration as well short, that can affect just how rewarding your realty endeavor remains in the long term.

If you're wanting to purchase a house to turn or as a rental property, it can be testing to get a typical home loan. If your credit history isn't where a traditional lending institution would like it or you require cash extra swiftly than a lender has the ability to offer it, you can be unfortunate.

What Does Hard Money Georgia Mean?

Tough cash fundings are temporary guaranteed loans that use the residential property you're acquiring as security. You will not discover one from your bank: Hard money car loans are supplied by different lending institutions such as specific capitalists and also exclusive firms, that normally ignore sub-par credit rating and also various other monetary elements and rather base their choice on the building to be collateralized (hard money georgia).

Difficult money car loans offer several advantages for consumers. These consist of: From beginning to end, a tough cash financing could take just a few days. Why? Tough cash lenders tend to position more weight on the worth of a residential or commercial property used as collateral than on a debtor's funds. That's because hard cash loan providers aren't required to adhere to the exact same regulations that typical loan providers are.

It's key to take into consideration all the dangers they reveal. While hard cash car loans come with benefits, navigate to this website a debtor must likewise consider the dangers. Amongst them are: Hard money lending institutions usually bill a higher rates of interest because they're presuming even more threat than a standard lending institution would. Once again, that's due to the fact that of the risk that a difficult cash loan provider is taking.

Everything about Hard Money Georgia

:max_bytes(150000):strip_icc()/terms_h_hard_money_loan-FINAL-b9af7690939e45d5a80e25ee55c83d40.jpg)

You're uncertain whether you can manage to pay off the hard cash lending in a brief time period. You've got a strong credit rating and also ought to be able to get a typical car loan that most likely lugs a lower rate of interest. Alternatives to tough cash car loans consist of typical mortgages, home equity fundings, friends-and-family loans or financing from the building's vendor.

Hard Money Georgia - Truths

It's important to take into consideration factors such as the lender's reputation and also rates of interest. You may ask a trusted property representative or a fellow residence flipper for recommendations. Once you have actually toenailed down the best tough cash loan provider, be prepared to: Create the down repayment, which usually is heftier than the down repayment for a conventional mortgage Collect the needed paperwork, such as evidence of earnings Potentially work with an attorney to go over the regards to the finance after you've been accepted Draw up a strategy for repaying visit the site the finance Just as with any kind of finance, evaluate the advantages and disadvantages of a hard cash car loan prior to you commit to loaning.Despite what sort of finance you choose, it's probably a good idea to examine your complimentary credit report as well as cost-free credit history report with Experian to see where your financial resources stand.

(or "private money finance") what's the initial point that goes through your mind? In prior years, some bad apples tarnished the difficult money providing market when a couple of predatory loan providers were trying to "loan-to-own", giving really risky financings to customers using genuine estate as collateral and intending to foreclose on the residential properties.

Report this wiki page